The reality is that capital is hard to come by, especially when operating costs are adding up from all sides. The purchase of new equipment, software and tools as well as hiring some staff to help get your business off the ground all comes at a hefty price tag. Thankfully there are opportunities for funding, at every stage of business, that can keep your goals on track and help you avoid major setbacks. Understanding what options are available to you and the procedure of how to obtain capital are the first steps you need to take.

Below, we outline specific types of funding and what business stage is best suited for each. We’ll help you find the funding that meets your business’s needs.

Types of Funding

The Pre-Seed Funding Stage

At this point, you are coming out of the bootstrapping stage, which means your startup is stretching its own financial resources. Typically, you are going to do this until you feel confident enough to approach angel investors, otherwise, you will be relying heavily on your own savings along with family and friends who are willing to lend a hand. This is also when you begin meeting with other founders that have been in the same industry before asking for information such as typical costs you will be incurring, finalizing an effective business model and strategies on how to operate your business.

Funding Sources Available:

- Personal savings

- Friends and family

- Angel investors

- Possibly venture level investors

Company ValuationCompanies at this stage usually valued at $10,000 to $100,000 by investors.

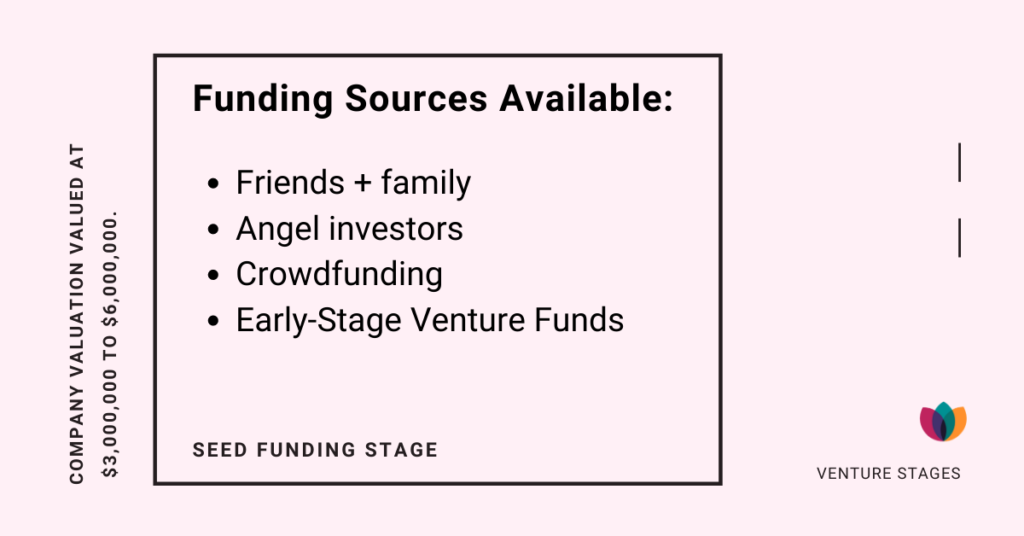

The Seed Funding Stage

At this stage, your startup is beginning to steadily generate revenue. This is when your business begins to provide equity in turn for seed funding when negotiating with venture capital investors. During this round of funding, most startups consider it a necessity in order to continue to grow in terms of marketing, hiring staff, and conducting in-depth market research for product-market-fit.

Funding Sources Available:

- Friends and family

- Angel investors

- Crowdfunding

- Early Stage Venture Funds

Company ValuationTo maximize your success for seed funding, your business should typically be valued at $3 million to $6 million dollars. Funding could range from $50,000 up to $3+ million if the company shows strong profitability.

Series A Funding Stage

In this round, investors will be looking into how much revenue your company is generating and the scalability of the product/service. Investors want to know who else is invested in your business and how much equity is available still. At this point, it is crucial to be planning for the long-term success of your business to ensure there is a strategy to continue to grow at a rate that is favourable to investors. Investors are no longer looking for “great ideas”, they want results and a business strategy that gives them ROI (return on investment).

There is a rule to follow when learning how fundraising works, called the 30-10-2 rule. This rule means you need to find at least 30 investors who are open to investing, 10 of those who are intrigued by your proposal and 2 investors that follow through to actually fund you.

It is important to focus on finding an “anchor” investor that is willing to work with you, at this stage. An “anchor” will help you progress towards your immediate goals and attract other investors to get involved to continue to scale. As the time-old adage says, it’s all about who you know.

Funding Sources Available:

- Accelerators

- Super Angel Investors

- Venture Capitalists

Company Valuation

Series A funding is for when your business is expected to generate $10 million to $30 million.

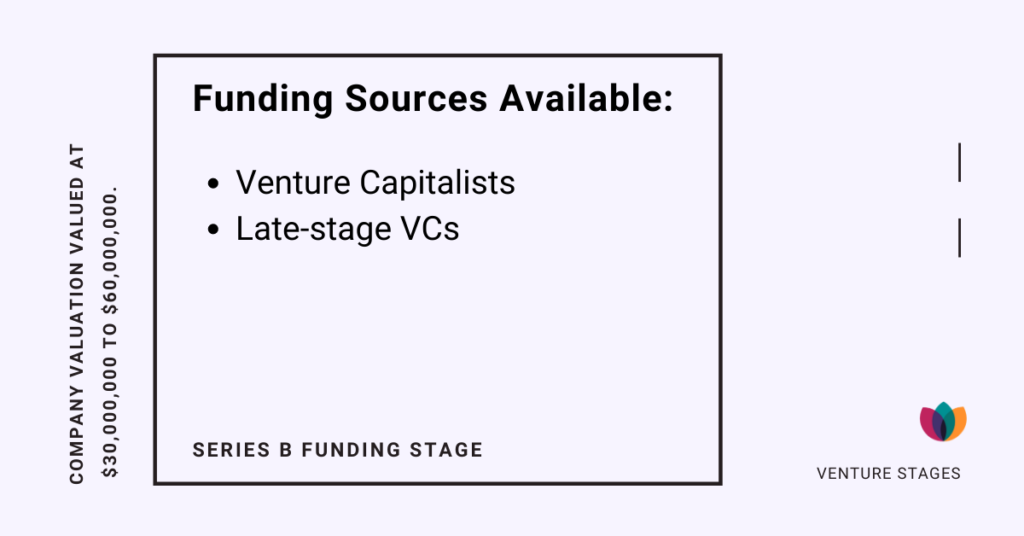

Series B Funding Stage

In this round, startups have successfully achieved all the necessary processes and obtained the proper funding from investors to move into this category of funding. Your business has proven to be scalable and profitable to investors, therefore, investors are going to begin funding to expand your horizons. Your business will now be enabled to finance market reach activities to grow market share. You will begin to start forming larger teams for marketing, business operations, and customer success. This allows your business to cater to customer needs and effectively compete in the market.

At this stage, many venture capital investors are wanting to take advantage of its profitability and push your business to new heights. Considering your business is at the point where it has the potential to go public, it is important to begin thinking about the investors you currently have and if they can help you get there. For example, if your business needs extra assistance in certain areas, like marketing, ensure you line yourself up with investors who can do more than provide just capital. Identifying what investors are key to your coming success will substantially foster the growth of your company.

Funding Sources Available:

- Venture Capitalists

- Late-stage VCs

Company Valuation

Fundraising at this stage is for companies valued up to $30 million to $60 million with the potential to raise up to $30 million.

Series C Funding Stage

Startups at this stage have proven to investors they are well into their growth path. You will be approached by other investors who want to secure their position as leading investors and invest significant amounts of money because you now pose less of a risk. This is almost the equivalent of sports team bandwagon-ing – now that your company is doing well, you are getting more support and interest from previously uninterested parties. They are now focused on scaling the business as effectively as possible to ensure they surpass the amount of money they already invested in profit. To accomplish this type of rapid growth, funding is allocated to manufacturing new products, tapping into new markets, and acquiring other startups in your space that are underachieving.

It is important now to consider strategic ways to apply funding to your business that will accelerate its growth and expand on a global stage.

Funding Sources Available:

- Private equity firms

- Late-stage VCs

- Banks

- Hedge Funds

Company Valuation

Companies that are on a consistent growth path valuing up to $100 million to $120 million have the potential to raise $50 million during this stage of funding.

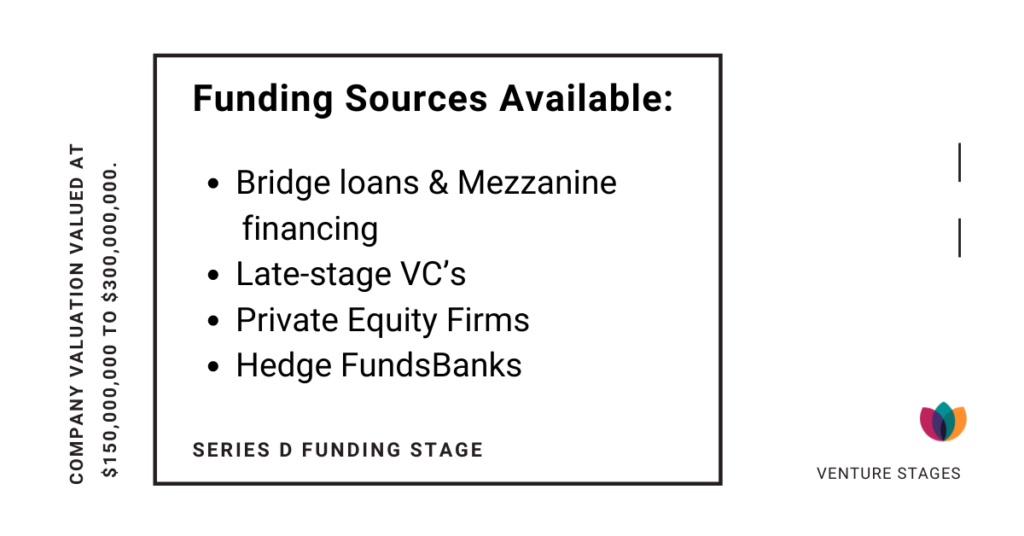

Series D Funding Stage

If your business is still unable to achieve considerable enough growth to go public, you may be starting to contemplate whether a merger with a competitor would be in your best interest, or continuing to acquire other startups to boost your revenue streams. These are very special situations and many entrepreneurs don’t find a need to go to this stage, typically. It is all about finding investment opportunities to hit your growth goal and catapult your business to the IPO (Initial Public Offering) stage.

Funding Sources Available:

- Bridge loans & Mezzanine financing

- Late-stage VC’s

- Private Equity Firms

- Hedge Funds

- Banks

Company Valuation

Your business is valued at around $150 million to $300 million and you may be able to raise approximately $100 million.

Initial Public Offering (IPO)

IPO, the process of going public, is when your company decides to offer corporate shares to the general public. Your company has now reached a point where all your ideas have become grounded in reality and you have a board of advisors, a large team of employees, strong partners, early investors and a multitude of customers to serve.

Once you open shares to the public, you become an employee to shareholders, and you are still expected to lead the ship unless you are asked to step down by your board. If there is a buyout, you will sell off all your remaining shares and gracefully exit to pursue other entrepreneurial endeavours.

Other Funding Options

Government Grants and Subsidies

The Canada Business Network website provides Canadians with a list of potential grants and subsidies that are geared to aid your business in its growth. These grants are distributed from both the federal and provincial levels.

Keep in mind, many grants are set up for you to match the contribution of the Government. It also may be difficult to get as there is competition for the grants from other entrepreneurs who applied.

If You Want to Apply, You Must Have:

- A comprehensive project description

- A portrayal of the benefits of your project

- Costing worksheet

- The expertise and background of manager involved

- Finished application form to submit.

Bank Loans

When considering this route, ensure that the banking institution you choose aligns with your overall goals in terms of repayment processes or advantages that can help you get ahead. It is important to note that banks are strict when it comes to credit scores and they need more than just a good idea. There needs to be a great business plan and they usually require the entrepreneur to have a personal guarantor.

Crowdfunding

This type of funding is available on online platforms such as Kickstarter and Indiegogo. It works by allowing friends, interested consumers, and colleagues to invest small amounts of capital into a business idea.

Once a company gains enough traction, they will begin attracting investors who may be able to take the business from the ideation stage into the launching products and/or services. This option requires a lot of time before results will be seen as it needs to be shared on social platforms and convincing enough for people to want to contribute. Furthermore, in order to reach potential funders, businesses will have to advertise the crowdfunding campaign, which will be a cost to factor in.

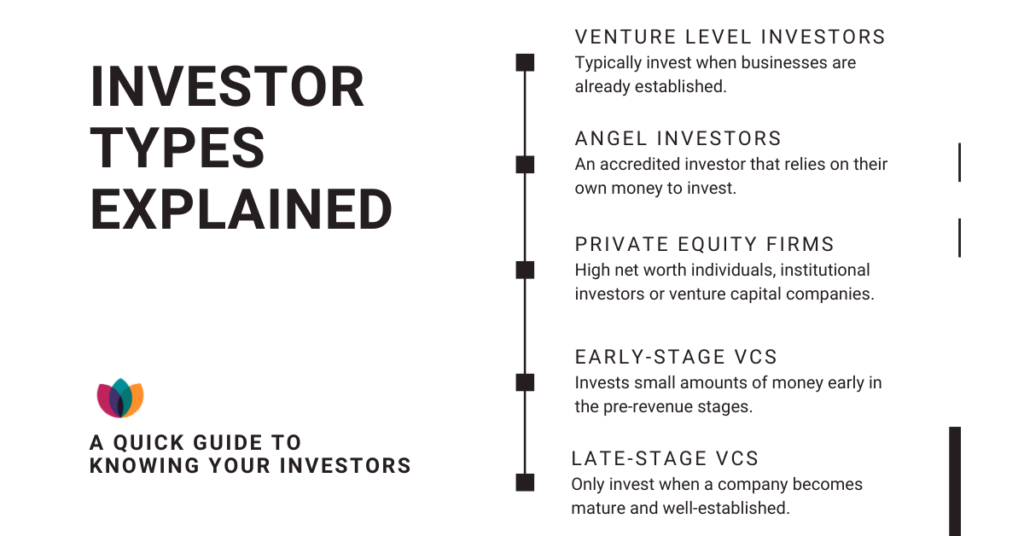

Investor Types Explained

- A person or a firm that invests in small companies

- Pooled funding that comes from investment companies, large corporations and pension funds

- Usually, they don’t use their personal money to invest

- Typically invest when businesses are already established to avoid risk, but may still invest if they believe strongly in the business plan

- An accredited investor that relies on their own money to invest in startups and small businesses

- To be a qualified investor, they need to have a net worth of $1 million and an annual income of at least $200,000

- Their terms of investment are usually aimed at helping startups grow their business and don’t expect to profit immediately from the investment

- Choose startups they are interested in, and believe will become profitable

Private Equity Firms

- High net worth individuals, institutional investors or venture capital companies

- Interest in funding company operations to provide investors profit within 4-7 years

- Equity firms usually take a certain of portion made for investors

- If the investment isn’t worth it, they may sell to another equity firm or a strategic buyer

- Provide mentorship to support businesses become more stable and independent

- Access to logistical and technical resources

- Shared office space allowing for a chance to network with other peers

- Typically lasts anywhere from 2-6 months

- Sometimes will take IP in businesses that run through their programs

Early-Stage VCs

- Invests small amounts of money early in the pre-revenue stages of a company

- Since it is a risky investment, they have to really believe in the idea and have expertise in the industry

- The goal is to invest early and continue to invest as the company grows

Late-Stage VCs

- Only invest when a company becomes mature and well-established

- Prefer less risk with less reward

- Usually, they invest when the company is well beyond the startup phase

Key Takeaway

There are many different avenues to obtain funding for your business, it all depends on your company stage and what is ultimately best for your company. What funding insights do you have to share?

Anas Khan

17 August 2020 at 10:31 amI have express a few of the articles on your website now, and I really like your style of blogging. I added it to my favorite’s blog site list and will be checking back soon.

• Post Author •

18 August 2020 at 12:07 pmThank you for the kind words and support! We always strive to create content that is relevant and interesting for the entrepreneurial community.

Caue of Death

4 October 2020 at 12:37 amwonderful post, very informative. I ponder why the opposite experts

of this sector don’t understand this. You should continue your writing.

I’m sure, you’ve a great readers’ base already!

5 October 2020 at 9:22 amThank you for your comment! Funding for businesses is an expansive topic that has a lot of information. We hoped to provide a good overview for entrepreneurs. If you’d like to see more content similar to this, follow us on social media @ciaccelerate.

venture capital firms

10 October 2020 at 6:52 amFrom this article you will get to know about the types of funding what’s the best fit for your venture. This article is very knowledgeable for everyone. You have really eased my work, loved your writing skill as well. I love your posts always. Please keep sharing more!

13 October 2020 at 9:02 amWe’re happy to be able to provide you with an overview of business funding! It’s great to hear that it’s been helpful. If you’d like to read more business-related tips and content, follow us @ciaccelerate on social media.

Ask Sawal

15 November 2020 at 10:12 pmI have been looking for this Venture Capital Firms article since long time. Thanks author.